real estate tax shelter example

The actual exam has 125 questions and 2 hours 30 minutes is given to complete it. LERTA Act 76 Application.

Tax Shelters Definition Types Examples Of Tax Shelter

It requires the city to value all co-ops and condos based on.

. See Tax Department response to novel coronavirus COVID-19 for more information. Even if youve kept it in relatively good condition over the years you have to ask yourself will buyers real estate agents and. 163j from targeting earnings stripping by highly leveraged foreign-owned US.

Pay Property Taxes Real estate taxes are paid one year in arrears. The second half of your real. In the towns of East Hampton Shelter.

163j The 2017 tax law known as the Tax Cuts and Jobs Act TCJA PL. For example a professor who is away from home for a whole year while on sabbatical cannot count that year as use for purposes of the exclusion. In the year 2020 property owners will be paying 2019 real estate taxes.

One of the main problems with taxing high-end second residences dates back to a law from the 1980s called Section 581. Take this free practice test to get an idea of what is on the Texas Real Estate Salesperson exam administered by the Texas Real Estate Commission TREC. The tax is paid to the county recorder in the county where the real property is located.

In fact LLCs afford investors one of the most versatile vehicles to shelter their taxes and protect their assets. Of the Countys 356967 taxable parcels 334344 experienced a value change for Tax Year 2022. For example a real estate LLC might hold several properties and set up a series LLC in a manner that prevents.

In North Carolina the County Assessor is responsible for listing appraising and assessing all real estate for tax purposes as prescribed by the General Statues. The bonus depreciation will likely shelter our entire income this year from federal taxes. C corporations to broadly targeting debt utilization by business taxpayers operating in any.

These assessments or appraisal values are generated as of January 1 of the last county wide reappraisal. In New York State. You can only have one principal residence at a time.

Transfer tax differs across the US. Purchase Price of 2600 2600 -. Real Estate Investment Trust - REIT.

Personal Tax -Real Estate- Change in Use of Real Property. The first half of your real estate taxes are due by midnight on April 30th. In real estate investing buildings may be depreciated over a certain amount of time and are one of the many tax advantages of the asset class.

However long the business owns and uses the asset or. Total tax liability capital gain tax recapture tax 25000 4750 29750. For example franchise tax obligations can be costly such as in California where its 800 per year per LLC.

The calculation is based on 80 per each increment of 500 with the first 500 being excepted from tax. Property owners are provided with an annual official notice of the assessed value of their real property for local tax purposes. The tax laws are structured to favor real estate investments and to some degree that makes sense given our countrys.

We did have to use leverage to achieve this but the apartment building should do very well with plans to force appreciation. A real estate investment trust or REIT is a company that owns operates or finances income-producing real estate. Real estate tax notices are mailed to the property owners in either late December or early January.

For example Colorado has a transfer tax rate of 001 while people in Pittsburgh have to deal with a 4 rate. If you live in more than one placefor example you have two homesthe property you use the majority of the time during the year will ordinarily. For example assume a taxpayer rented out their principal residence on June 1 2006 after living in it since 1996 and moved into a friend or relatives home.

115-97 fundamentally shifted the scope of the interest expense deduction limitation under Sec. Most residential rental property is depreciated at a. Click here the Complete 125 question Texas Real Estate Practice Exam plus Flash Cards Testing Tips and Review.

Our goal is to value every property as fairly accurately and equitable. Code of Virginia 581-3330 This notice is not a tax bill. Getting To Know Section 721 Exchange Many tax professionals and real estate investors may be keenly aware of the 1031 Exchange program utilized by REITs as a method of acquiring properties from investors who are interested in selling their real estate investments and must find a replacement property as part of a 1031 exchange otherwise pay hefty capital gains.

Therefore tax payable on recapture is 50 x 9500 4750. Depreciation is how businesses are able to deduct the cost of an asset over one of two ways whatever is shorter. The notices will be sent to all County real estate owners.

Paradigm shift in new Sec. Another example of this type of tax is the fee for registering a motor vehicle. For a company to qualify as a REIT it must.

What Happens in Childrens Court. The assessed value provides the basis for the real estate taxes that will be due on July 28 and December 5. What is the real estate transfer tax rate in New York.

The home was owned for 17 years 1996 to 2012 inclusive so the PRE would shelter 1617ths of. Real Estate Assessment Notices. The assets useful life as determined by the IRS.

Owners of property subject to a tax lien sale or tax foreclosure who own ten or fewer residential dwelling units including their primary residence may declare a COVID-19-related hardship if they meet certain conditions. Similar to the calculation of capital gain tax above we use the highest marginal tax rate of 50 to estimate the tax. Mortgage rates exceed 5 home sales drop.

The taxpayer filed a s. The Fairfax County Department of Tax Administration DTA begins mailing Tax Year 2022 real estate assessment notices to County taxpayers today. Rental property owners can deduct the costs of owning maintaining and operating the property.

Tax Shelter Definition Examples Using Deductions

Real Estate Tax Invoice Template Google Docs Google Sheets Excel Word Template Net Invoice Template Estate Tax Google Sheets

Sample Non Profit Donation How To Create A Non Profit Donation Download This Sample Non Profit Donation Te Receipt Template Donation Letter Letter Templates

Income Tax Calculation For Professional Cricketer 1 5 Cr Husband And Wife Income Tax Budgeting Income

The Competition Is Fierce And You Need To Stand Out But How View Our Outstanding Nanny Cover Let Cover Letter Example Letter Example Letter Writing For Kids

Professional Curriculum Vitae Resume Template For All Job Seekers Sample Of Template Of An Excellent I Accountant Resume Resume Writing Format Resume Format

Barclays Bank Statement Bank Statement Payroll Template Bill Template

What Is The Biggest Tax Shelter For Most Taxpayers

Personal Trainer Workout Plan Template Best Of Index Of Cdn 5 2012 14 Workout Plan Template Personalized Workout Plan Business Plan Template

How Is A Tax Shelter Calculated In Real Estate

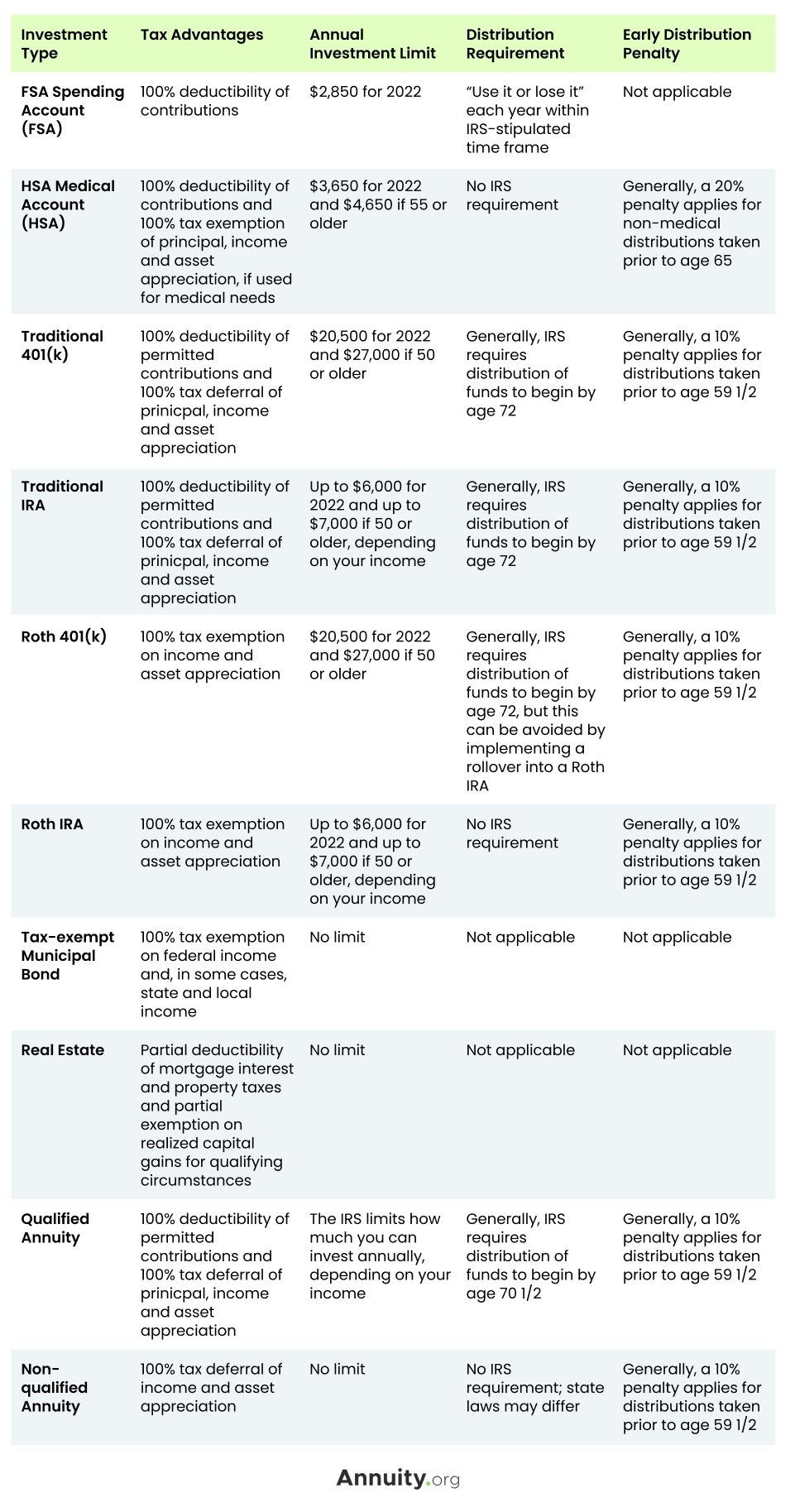

What Are Tax Sheltered Investments Types Risks Benefits

Small Business Financial Statement Template Inspirational Small Business Financial Statement Template L Statement Template Financial Statement Income Statement

Diy Or Hiring A Property Manager Which Is Better Property Management Real Estate Quotes Management

Income From Cloud Hosting And Its Ancillary Services Neither Royalty Nor Fts Itat Income Hosting Profitable Business

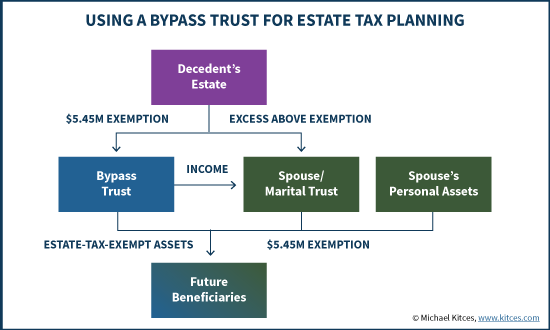

Distributable Net Income Tax Rules For Bypass Trusts

Tax Shelter Difference Between Tax Shelter And Tax Evasion

Small Business Financial Statement Template Inspirational Small Business Financial Statement Template L Statement Template Financial Statement Income Statement